Disclaimer

Clearpay lends you a fixed amount of credit so you can pay for your purchase over 4 installments, due every 2 weeks.

Ensure you can make repayments on time. You must be 18+ and a permanent UK resident (excl Channel Islands).

Clearpay charges a £6 late fee for each late installment and a further £6 if it's still unpaid 7 days later.

Late fees are capped at £6 for orders under £24 and the lower of £24 or 25% of the order value for orders over £24.

Missed payments may affect your ability to use Clearpay in the future and your details may be passed onto a debt collection agency working on Clearpay's behalf. Clearpay is credit that is not regulated by the Financial Conduct Authority.

T&Cs and other eligibilty criteria apply at clearpay.co.uk/terms

Bathroom City presents online shoppers with Clearpay – a quick and easy buy-now-pay-later (BNPL) option that allows you to pay for your purchases in convenient instalments.

Since Clearpay does not charge interest or fees for on-time payments, it’s a win-win for both merchants and shoppers.

What Is Clearpay?

Clearpay is a powerful payment option that doesn’t charge interest or fees, enhancing customers’ shopping experience and boosting merchants’ sales.

You can spread your payments over time, making expensive purchases accessible and manageable.

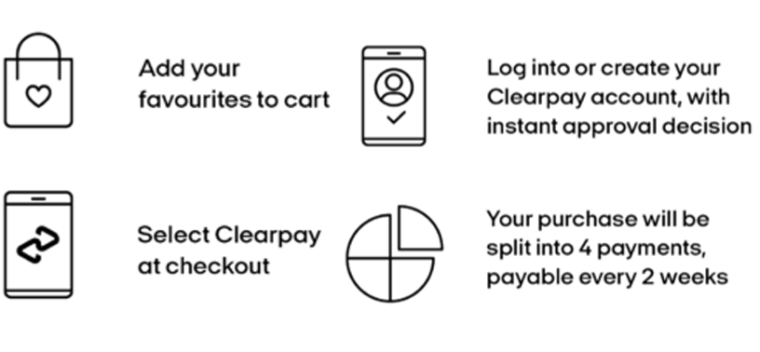

How Does Clearpay Work?

Clearpay lends a shopper a fixed amount of credit. You can pay for your purchase over four instalments, due every two weeks. That is, you will make the full payment in six weeks.

The first payment is due at the time of purchase.

The remaining three remittances are deducted automatically every two weeks from the payment method you select.

Clear Payment Plans and Instalments

An Order is the request to finance the purchase of goods.

A Clearpay Plan is the credit plan that sets out the rules of financing an Order.

The Order and Clearpay Plan are the documents that form a legal agreement between you, the purchaser, and Clearpay.

Other than the scheduled bi-weekly payments, you can also make additional unscheduled payments before the due date.

You can make early payments by logging in to your account on the Clearpay website.

How to Apply for Clearpay at Checkout?

For an online purchase, you don’t need to register before your first Clearpay transaction.

When you purchase an item at the Bathroom City online store, select Clearpay as the payment method at checkout.

Next, provide payment details as you would normally do to complete your purchase.

Upon order approval, your Clearpay account is created.

Now, download the Clearpay app on your Smartphone or visit www.clearpay.co.uk and set up a password.

Enter your login details upon checkout.

Refunds and Returns with Clearpay

Step 1: To return an item, please contact Bathroom City and arrange the return.

Step 2: Bathroom City will process the returned item/s.

Step 3: Notify Clearpay of the return by using the Pause and Notify feature on the app.

Step 4: Clearpay will process the return and pause your payments. This will help you avoid a late payment fee.

Step 5: Immediately after Bathroom City receives the returned item/s and confirms the refund, Clearpay will refund the applicable amount to the payment card used to make the payment.

Frequently Asked Questions (FAQs) about Clearpay

1. What Are the Eligibility Criteria to Use Clearpay?

To sign up with Clearpay, you must fulfil the following eligibility criteria:

- Be a minimum of 18 years old

- Have an authentic and verifiable phone number and email address

- Be competent to enter into a legally binding contract

- Use a UK bank payment – Mastercard or Visa Credit or Debit Card

- Have a valid ID

- Be a UK resident (England/Scotland/Wales/Northern Ireland).

2. Do I Need to Have a Clearpay Account?

Yes. First-time buyers must create a Clearpay account (with a quick approval decision), and returning shoppers will have to simply log in to their account to complete a purchase.

3. What Happens If I Can’t Pay a Clearpay Instalment?

An Account Pause will result as soon as you miss a Clearpay instalment payment. Consequently, you cannot make further purchases with Clearpay.

You have time until 11 pm the following day to clear the outstanding payment. If you fail to make the payment before this deadline passes, you will be charged a late fee.

The late fee for an instalment is £6, and an additional £6 if it remains unpaid 7 days later.

The late fees for orders under £24 are capped at £6. For orders over £24, the late fee is the lower of £24 or 25% of the order value.

4. Is Paying with Clearpay Safe?

At Clearpay, compliance is of prime importance. Cardholder data is safeguarded to the highest degree.

Clearpay is a PCI-DSS Level 1 certified organisation.

PCI-DSS is an exhaustive set of strict requirements stipulated by the Payment Card Industry Security Standards Council to prevent any breach in cardholder data.

Clearpay is also an ISO/IEC 27001 certified organisation that constantly improves its information security management system.

5. Can I Make a Phone Order and Apply for Clearpay?

No, Clearpay can only be used on purchases made online.

6. Is There a Limit to How Much I Can Spend on a Single Clearpay Transaction?

Yes, the amount you can spend on a single Clearpay transaction, including shipping, must not exceed £1,200.

If your order exceeds £1,200, you can split the order and use another payment option to pay the extra amount.