Disclaimer

Klarna offers pay later services based on a number of factors such as the purchase amount and previous order history.

If you are 18 or over, you can improve your chances of being offered Klarna by ensuring you provide your full name, phone number, address and arrange shipping to your registered billing address.

If you have been accepted to use Klarna, it does not mean it will be offered for every order. Borrowing more than you can afford could seriously affect your financial status. Make sure you can afford your monthly repayments and please spend responsibly.

Bathroom City presents online shoppers with Klarna – a hassle-free and zero-interest buy-now-pay-later (BNPL) plan that affords them the ease of paying for their purchases in timely instalments.

Klarna empowers you to take control of your finances and get rid of revolving credit. Unlike in other payment options, you’ll not get stuck in a credit trap with burdensome interest payments and low instalments.

What Is Klarna?

Klarna is a powerful payment service that aims to make shopping online easier, providing shoppers with smarter and more flexible purchase experiences.

This intelligent way to shop and pay provides shoppers access to goods and services from top brands and enables them to stretch out their payments over time, making big-ticket purchases accessible and manageable.

The main benefit of the Klarna payment plan is it helps shoppers make savvy spending choices and pay on time. Other features include secure shopping and lightning-fast checkout.

How Does Klarna Work?

Klarna splits the total cost. That is, you make a purchase and decide how you want to pay: instalments or deferred payments.

At Klarna, approval decisions are automated. The available shared customer data from credit reference agencies will play a decisive role in the approval process.

Your track record of previous timely payments and total outstanding debts are the primary determining factors.

Klarna Payment Options and Plans

The various payment options that Klarna offers include:

1. Pay in 3 Instalments

In this plan, the cost of the item is divided into three equal instalments.

You’ll see the Pay in 3 interest-free instalments option at checkout. To complete your purchase, opt for this option and enter your card details.

Klarna does not charge any interest/fees for using a debit/credit card to make the payment.

Note: Late payment will attract a late payment charge.

2. Pay Later in 30 Days

As the name of the plan suggests, you can pay for the item/s you buy within 30 days from the date of order placement or shipment of the goods.

You will receive a payment reminder from Klarna with details on how to make a direct payment. In case you have opted for the auto pay feature, you will be notified of the upcoming payment.

You also have the option to pay off the balance before the 30-day deadline. However, any delay in payment will attract a late payment charge.

3. Financing

While there is no interest or fees for the first two plans, this plan charges interest at 18.9% Annual Percentage Rate (APR).

Under the Klarna Financing plan, you can make 12 equal monthly payments for your purchase amount.

For example, if you purchase goods for £1,200, you can pay that amount with interest in 12 equal monthly instalments of £110.53. The total amount payable is £1,326.37.

How to Apply for Klarna?

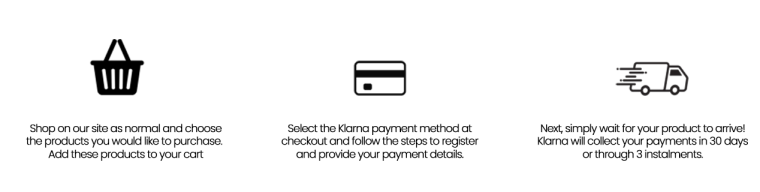

Step 1: At checkout, choose to pay with Klarna.

Step 2: Sign up via the Klarna app or the Klarna card. Log into your Klarna account once the pop-up window opens.

Step 3: Select your preferred Klarna payment method.

Refunds and Returns with Klarna

When returning an order or part of it, follow Bathroom City’s return policy and provide evidence of the return.

When returning by post, retain the return tracking number as evidence. Give Bathroom City reasonable time to receive the items and process the refund.

When returning in-store, retain the return receipt as evidence. Typically, it takes a few days to process the refund.

Make a claim with Klarna in case you don’t receive a refund after a reasonable amount of time. Log into the Klarna web portal or app and locate the purchase. From the options provided, select Report a return.

Klarna will contact Bathroom City and request an update from them. Your payment will be paused until the issue is resolved.

Frequently Asked Questions (FAQs) about Klarna

1. What Are the Eligibility Criteria to Apply for Klarna?

The following are the eligibility criteria to apply for Klarna:

- Be a resident of the UK.

- Be a minimum of 18 years of age.

- Have a valid bank account and credit/debit card.

- Have a good credit history.

- Receive verification codes via text.

2. Do I Need to Have a Klarna Account?

Yes, you must have a Klarna account to use the Klarna payment option in the UK.

3. Does Klarna Affect My Credit Score?

Klarna’s payment process will not impact your credit score for on-time payments.

However, since Klarna shares information with two of the UK’s major credit reference agencies about the way you use Klarna, your purchase and repayment dates could appear on your credit history.

Hence, timely payments will build a positive repayment record, while delayed/missed payments will affect your credit score negatively.

4. Is Paying with Klarna Safe?

Klarna has strong security features, such as encryption and fraud protection, in place to protect shoppers and prevent unauthorised purchases.

Klarna’s Buyer Protection Policy assures you of extra safety when you shop with Klarna.

5. Can I Make a Phone Order and Apply for Klarna?

Unfortunately, that’s not possible.

Klarna payment option is only available when you make online purchases through the Bathroom City website.

6. Is There a Limit to How Much I Can Spend on a Single Klarna Transaction?

No limit is set on how much you can spend on a single Klarna transaction.

The amount you can spend on any given Klarna transaction is determined by a new automated approval decision.

7. What Do I Do If I am Unsuccessful in Applying for Klarna?

The approval decisions are fully automated, and Bathroom City does NOT have any control over the applying/approval process.

For further support, please contact Klarna Customer Service.

Paypal credit is an alternate payment option.